What's a 1031 exchange?

1031 Exchanges Explained

A 1031 exchange, or like-kind exchange, is an effective tax-deferral tactic that allows real estate investors to postpone paying capital gains taxes. By selling one investment property and reinvesting the proceeds into another of similar or greater value, investors can utilize this strategy under Section 1031 of the Internal Revenue Code to defer capital gains and depreciation recapture taxes on qualified properties. This tax is often 30%+ of their capital gain.

Tax-deferred real estate exchanges have been part of the US tax code for over 100 years and annual 1031 transaction volume currently exceeds $100 billion.

Tax Calculation

1031 Exchange Rules

For a successful 1031 exchange, it’s crucial to adhere to specific regulations. This section outlines the necessary rules and requirements that real estate investors must follow to defer capital gains taxes under Section 1031 of the Internal Revenue Code.

"Like-Kind" Property

- IRS term for real estate located in the USA

- No equipment, art, etc.

Business or

Investment Use

- Used for business or investment purposes

- Single-family rentals typically qualify

1031 Exchange Timeline

- Identify replacement properties in 45 days

- Close on replacement property in 180 days

Equal or Greater Value

- For FULL deferral, all sales equity reinvested

- AND greater replacement property(ies) value

Same Taxpayer on Title

- Same taxpayer on replacement(s) title

- DSTs must have same taxpayer and bene (later)

Exchanger Can't Receive 1031 Funds

- Exchanger can’t receive sales equity

- Hire Qualified Intermediary (QI) to hold funds

The 1031 Exchange Timeline

The 1031 exchange timeline is a critical component, requiring investors to identify a replacement property within 45 days and complete the purchase within 180 days of selling their original asset.

This stringent timeline can pose challenges, as investors must quickly find suitable properties and finalize transactions, which can be particularly demanding in competitive or fluctuating real estate markets.

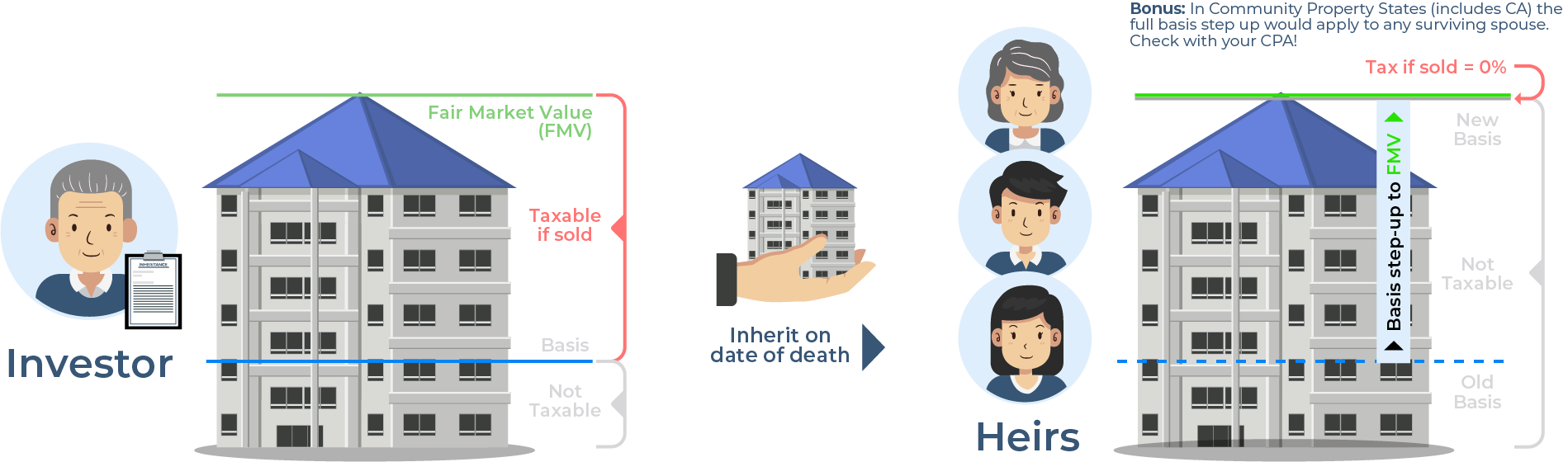

Swap 'Till You Drop

Defer Taxes Forever!

“Swap ’till you drop” is a term often used to describe the strategy in which a real estate investor 1031 exchanges to defer taxes forever. Forever meaning when the investor dies, their heirs receive a step-up in basis and never pay taxes on that gain.